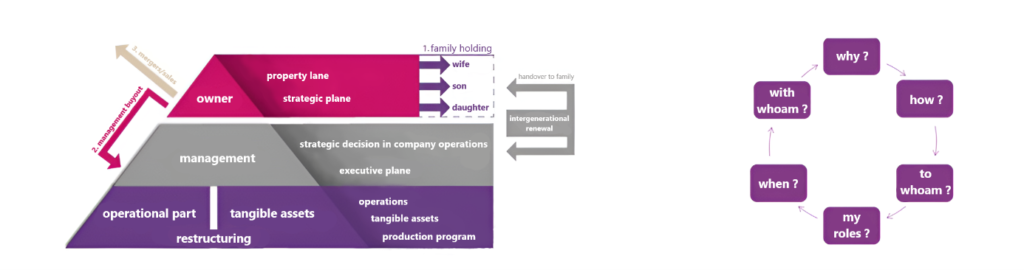

Intergenerational change refers to the process when the owner(s) of a company want to terminate or reduce their active involvement in the company and devote more time to other activities or leisure. In the context of a family business transfer, the owner(s) of the company will usually consider the possibility of involving a family member, usually a descendant, whom they see as their successor. If he or she decides to do so, the next decision-making process is whether to hand over the company as a whole to the chosen successor or whether the company will be managed by a family holding company.

Intergenerational renewal is an opportunity to think deeply about the future of the company, the vision of the family and the company at the same time.

1. Passing on the company within the family

This is the simplest direct transfer of property to certain family members.

It is an opportunity to create shareholder mechanisms that should both protect the family’s interests in maintaining control and value of the firm, while still allowing the firm to operate. Often the biggest enemy of family firms is internal dispute, and the blockage of decision-making mechanisms is precisely one of the main causes of the dissolution of more than just family firms.

The first step is the actual establishment of the necessary corporate structure, which may take the form of a partnership, various types of trusts, foundations and so on. As mentioned above, the form of the structure depends on the needs of the family. However, keeping in mind the long-term aspect, we are setting up a structure to exist for many years to come.

The final form should therefore not be determined solely by the current state of the legislative environment, as we see today in some cases of family consolidation. The shareholders or beneficiaries of the family holding company will be the members of the family in such proportions and lay out as will be agreed within the family.

The shareholders’ agreement then precisely defines the rights and obligations of the individual family members, who in turn appoint the managers of the individual companies controlled by the family holding. Many times, a necessary step in creating a well-adjusted family holding company is also the restructuring of the current companies that create value, profit and are the basis of the family’s income.

It is necessary to think about the future functioning of the companies in question, to set new rules for internal communication, to establish new management and control procedures. Furthermore, the company’s assets may also be restructured. For example, the separation of tangible assets from production processes. These steps can significantly help to protect family assets and preserve prosperity in the future.

At the beginning of the whole process of transferring the company to the descendants, two basic questions need to be answered – Why do I want to pass the company on? What outcome do I expect? A well-established family strategy based on mutual trust and loyalty, preceded by long, frank and not always pleasant discussions, will help answer this. Clarifying and cleaning up the family relationships will then provide the basis for writing all the necessary rules, set goals backed by a clear vision into a Family Constitution. The Family Constitution is a document that defines the vision of how the family functions within the business environment, defining the family’s core values, especially in relation to the ownership of the family business. Approach the family constitution as something that is primarily aimed at conflict prevention.

It will not, of course, resolve conflicts on its own. However, it should be legally enforceable so that you can enforce the rules you jointly determine for key areas. These are, for example, the payment and calculation of dividends or the scope of powers and duties of directors and owners. A shareholders’ agreement will help you to do this.

2. PROFESSIONAL MANAGERS

Leave the creation of governing bodies in the form of supervisory boards and the operation of the company to professional managers who report to a “family council”.

When the founders of a company decide on succession, it is often the case that they have no one to hand over the company to. The company can then be transformed into a family holding company, the property rights of the individual members will be clearly defined, as well as the responsibilities for controlling the operation of the company and fulfilling the vision for its future development.

If we are looking at the management ranks as part of the company’s succession solution, we have a certain advantage due to the personal relationships we have already built up. If the transfer is done in the classic sale way, the preparation of the company for the sale will probably be easier (management usually knows the company perfectly), but the actual structure of the sale and the transaction documentation (financing of the acquisition, guarantees for the bank, transaction settlement over time, etc.) will probably be more complex.

In any case, we can also opt for the alternative that the company is only partially in the hands of management. A certain share of the strategic decision-making processes would remain with the original owner or his family.

Establishment of a family holding

The establishment of a family holding is only a legal act, when we establish a company according to the applicable laws of the Czech Republic. It can be a limited liability company, a joint stock company or any other legal form.

However, what is more important is how the members of this newly formed company agree on its functioning. It is necessary to clarify the reasons why it is being created, the vision of how it is to be managed over time and over the next generations, the principles of handling family property, how transfers of ownership will take place, how disputes will be resolved, etc.

In the context of establishing a family holding company, it is advisable to already set up the structure and processes of the new company. Since the aim is to accumulate the family assets so that they are preserved for future generations, real estate assets can be partly transferred to the company straight away and continue to be managed by the family holding company.

It is also appropriate to set up ownership structures in relation to the companies controlled (managed) by the family holding company – transfer of shares to the family holding company.

COMPANY CONSTITUTION

The company constitution is a document, or rather we can say a code, in which the founders set their idea of the family’s functioning within the business environment – a family holding.

It gives an idea of how the family property should be preserved for future generations, how it should be managed and developed.

It should set rules for the possibility of involvement of individual family members within the holding, controlled companies and real estate.

3. TRUSTS OR STRUCTURED FAMILY HOLDINGS

Arising mainly for reasons of accumulation and protection of family assets.

This is the process of transferring the company into the hands of another person or company. This is already a classic form of M&A sale of a company. It is necessary to prepare the company in a certain way and also to take some basic steps for a successful sale of the company.

DELEGATING THE MANAGEMENT OF THE COMPANY TO AN EXTERNAL MANAGER

In a situation where there is not a suitable family successor (or he or she has not yet grown up), but we still want to keep the company within the family for future generations, we can use the option of hiring external managers.

This may be for a limited period of time until the project is completed or until family management can be engaged.

The priority interest, in most cases, is the maintenance of the existing family assets, with development being more of a secondary requirement.

It is about managing the assets in a way where management takes specific actions based on a joint agreement with the members of the family holding that determine the strategic objectives, decisions and general requirements for the management of their assets.

COMPLETE DIVESTMENT OF THE COMPANY

When considering leaving active participation in the running of the company, we may find ourselves in a situation where we are unable to identify suitable successors. No one in the family is a suitable candidate, or perhaps they don’t want to continue the work that has been started, or there just isn’t a successor. Nor are there suitable, capable and willing successors among the current management team.

In this case, if we are already determined not to continue the business (whether for health reasons, interest in other activities or other reasons), we would probably recommend thinking about selling the company. This step needs to be well thought out and, most importantly, some preparations need to be made. We discuss this issue further on the following page.

SAMAK will help with the implementation and proper setup of your ideas for the future operation of the company, whether in the form of a family holding, trust or other. Our advisors can significantly assist in translating your visions for the future operation of the company into a realistic form, even with mutual family ties. They can help guide you through the entire conversion process, both legally, accounting and tax-wise.