Don’t waste your time, because the law does not protect those who do not enforce their claims. Out-of-court recovery has no set time limits, it is based on the voluntary performance of the debtor and does not impose a statute of limitations.

Claim the costs of recovery. Czech courts only accept legal costs for recovery through an attorney-at-law.

Do not pay higher taxes than you have to. You can only write off your debt for tax purposes and claim a refund of the VAT you have paid if you recover it in court.

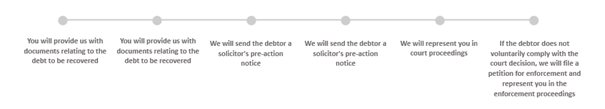

Our method of proceeding simply consists of:

- precise orientation in the case;

- designing an appropriate strategy that takes into account the client’s interests;

- defining the crucial arguments and defenses;

- taking into account potential human aspects of a particular dispute;

- continuously evaluating progress throughout the litigation process;

- taking into account the latest development of legislation and trends in case law during all phases of the dispute from a procedural and substantive perspective.

It goes without saying that we take a balanced approach to the risks and costs of litigation.

2. Corporate Disputes

Disputes between members of corporations (shareholders, etc.) and their bodies complicate the normal functioning of a business corporation and often even paralyze its activities. These disputes can lead to permanent damage or even the dissolution of a business corporation, even if its business is otherwise healthy and successful. Corporate litigation allows these problematic situations to be resolved either out of court or through litigation.

WHAT IS THE BENEFIT?

We will represent you in the dispute and thus remove the personal aspect of the dispute. We will find an appropriate solution to the dispute, eliminate unnecessary or chicane filings of the parties to the dispute, or address procedures against problematic members of corporations and members of their bodies.

WHAT IS THE ADDED VALUE OF OUR SERVICES?

Our philosophy of corporate litigation considers the preservation of the business of the corporation itself to be the primary goal, as this is usually what the parties to a dispute always agree on and what all parties generally seek. From this perspective, we then look for a business-optimal win-win solution. At SAMAK, we work with colleagues with corporate, tax and business practices and can therefore also find the technically optimal solution.

3. Representation in court proceedings

Within the ordinary course of business, dozens of disputes arise for a variety of reasons, ranging from the normal day-to-day running of a business through disputes arising from non-compliance or even breach of contracts or legal regulations, ultimately impacting the financial situation of these business entities.

WHAT IS THE BENEFIT?

We will carry out a comprehensive assessment of the matter and propose effective defence strategy against unjustified claims of other entities or, on the contrary, an effective assertion of our own claims arising from business activities. Of course, we also distinguish and eliminate unnecessary litigation, as opposed to effective assertion of one’s rights in court proceedings.

WHAT IS THE ADDED VALUE OF OUR SERVICES?

We are able to assess the matter in dispute and select the most appropriate course of action, taking into account the risks of the dispute, as every dispute can carry risks. At the same time, we pay attention to the preparation of the procedural and factual aspects of the dispute from the outset and, given our long-term experience in representation in courts of all levels, we also take into account the latest developments in case law or trends in decision-making practice. We strive to fight for our clients with the utmost commitment, to deal with the courts with the appropriate respect on the one hand, but on the other hand we are also prepared to argue effectively with the courts on opinions and legal conclusions as necessary. Disputes often end up in these higher courts. We are also always prepared to negotiate a favorable conciliation or out-of-court settlement if, in our opinion, this corresponds to the overall situation of the dispute. We do not underestimate the human factor in litigation, which often makes a significant difference in the courtroom. Furthermore, within the firm, we also use our long experience in the contractual agenda, advising clients in the context of business activities, experience in the corporate area, etc., and we cooperate with other members of the firm specializing in this agenda.

4. Representation in administrative justice

At the present, there is increasing interference of the tax administration and other state and local government bodies in the ordinary activities and business activities. The tax administration or state administration authorities often act selectively or exceed the legal regulations governing their activities in specific cases.

WHAT IS THE BENEFIT?

We will prepare an effective defense strategy against unlawful or problematic actions of tax administration authorities or other state or local government bodies.

We will assess the situation and eliminate erroneous procedural actions at the beginning of the proceedings or disputes, including quality preparation of the dispute in terms of procedure and facts.

WHAT IS THE ADDED VALUE OF OUR SERVICES?

We cooperate with experienced tax advisors within the firm, which is why we are able to assess the risks and positive and negative impacts of the entire proceedings and litigation for the client, including cases involving complex tax or specialized administrative issues.

5. Employment disputes

Comprehensive resolution of employer-employee disputes, as the Labour Code and other labour law regulations are still based on the employee protection principle and in the event of an inappropriately chosen method of termination or failure to comply with the formal requirements for termination documentation, the employer may incur significant costs.

WHAT IS THE BENEFIT?

For employers, saving your costs in the event of unjustified claims by employees, or reducing unnecessary future costs in the event of problematic terminations.

For employees, on the other hand, to enforce their legitimate claims arising in the context of the employment relationship.

WHAT IS THE ADDED VALUE OF OUR SERVICES?

We are able to comprehensively assess and evaluate the overall impact of an employment dispute for both employees and employers, including financial impact. We are also able to negotiate and secure a comprehensive out-of-court settlement of the matter, eliminating future litigation costs altogether.

SAMAK also handles liability litigation and criminal defense in property and economic matters. Do not hesitate to contact us.