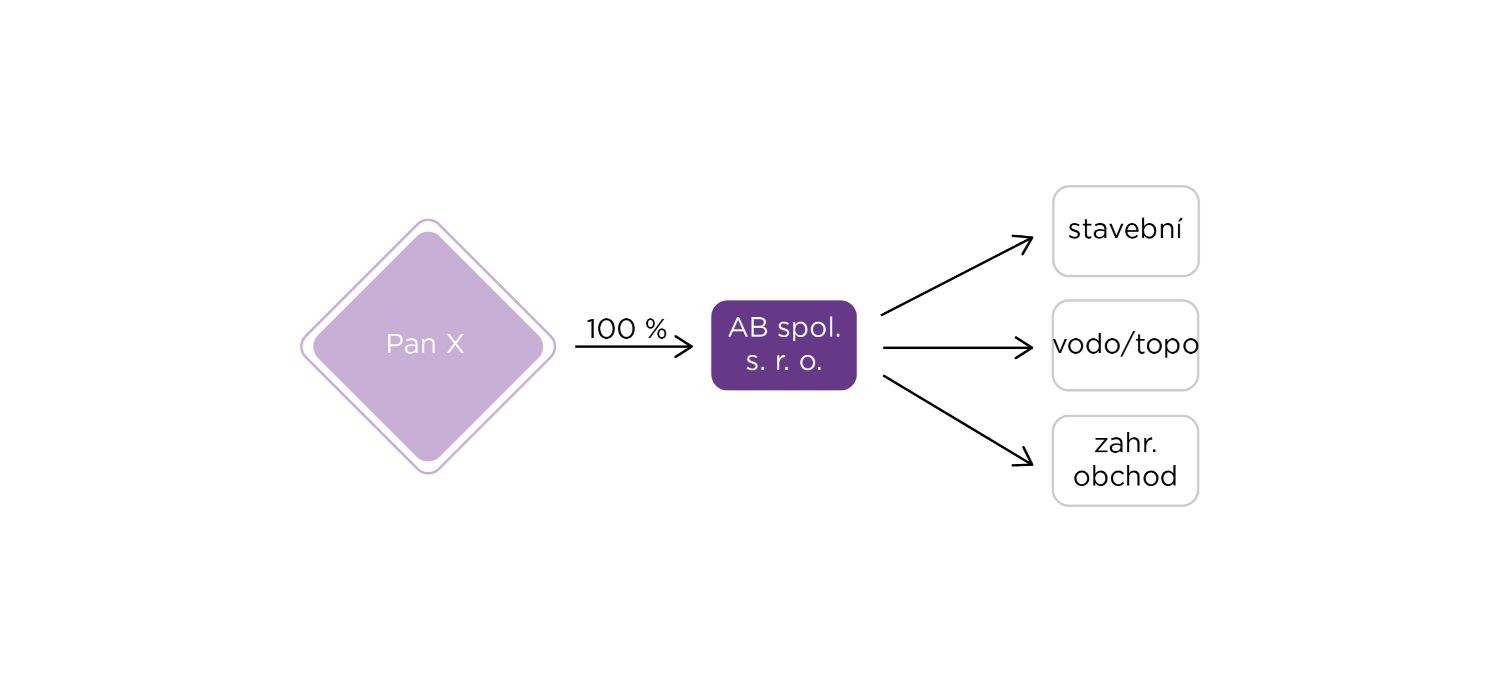

Original condition:

- Company – construction activity

- One 100% owner

- Turnover approx. 100 mil CZK / year

- Construction company operations + real estate assets (approx. 30 mil)

Reasons:

- Protection of company assets – diversification of business risks

- Involvement of family members in decision-making processes

- Preparing the company for a possible sale / partial sale

- Development of other / additional business activities

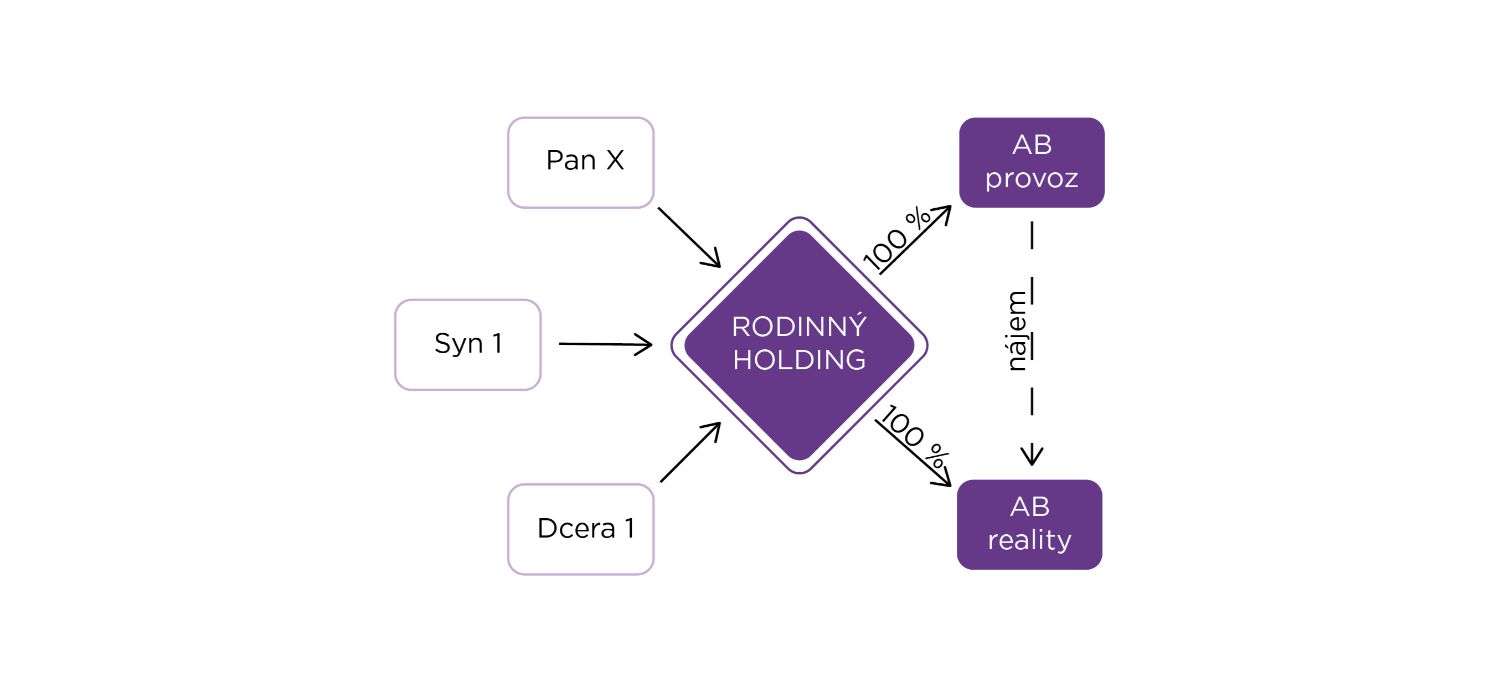

Solution:

- Creation of a new company – family holding. Shares divided among family members. Setting up rules for operation – family constitution. Resolution of SJM, inheritance.

- Creation of a new company by splitting off from the original operating company.

- Family holding company functions as a company for the accumulation and development of family assets.

Proposal for possible restructuring

Existing structure

Design of the future state

Design of the future state

We offer an objective perspective on the issue of intergenerational change. Thanks to our experience, broad expert team and reliability, we will support and advise you throughout the process.