Original condition:

- Company – metal production

- Family business – 100% owner, heirs were not suitable successors

- Turnover approx. 150 mil CZK / year

- Approx. 100 employees

Reasons:

- Keeping the company running as a source of income for the family.

- Preparing the company for sale / partial sale.

- Possible development of other / additional business activities

Solution:

Creation of a new company – family holding. Shares divided among family members. Establishment of rules for operation – family constitution. No threat to the running of the operating companies in case of any accidents or incidents.

Creation of a new company by separating from the original operating company – real estate assets spun off into a family holding company. Establishment of real estate activities.

Preparation of the operating company for sale / partial sale

Partial sale of the stake in the operating company to the current management of the company (to provide income for the family holding company and retain strategic decision-making powers)

Proposal for possible restructuring

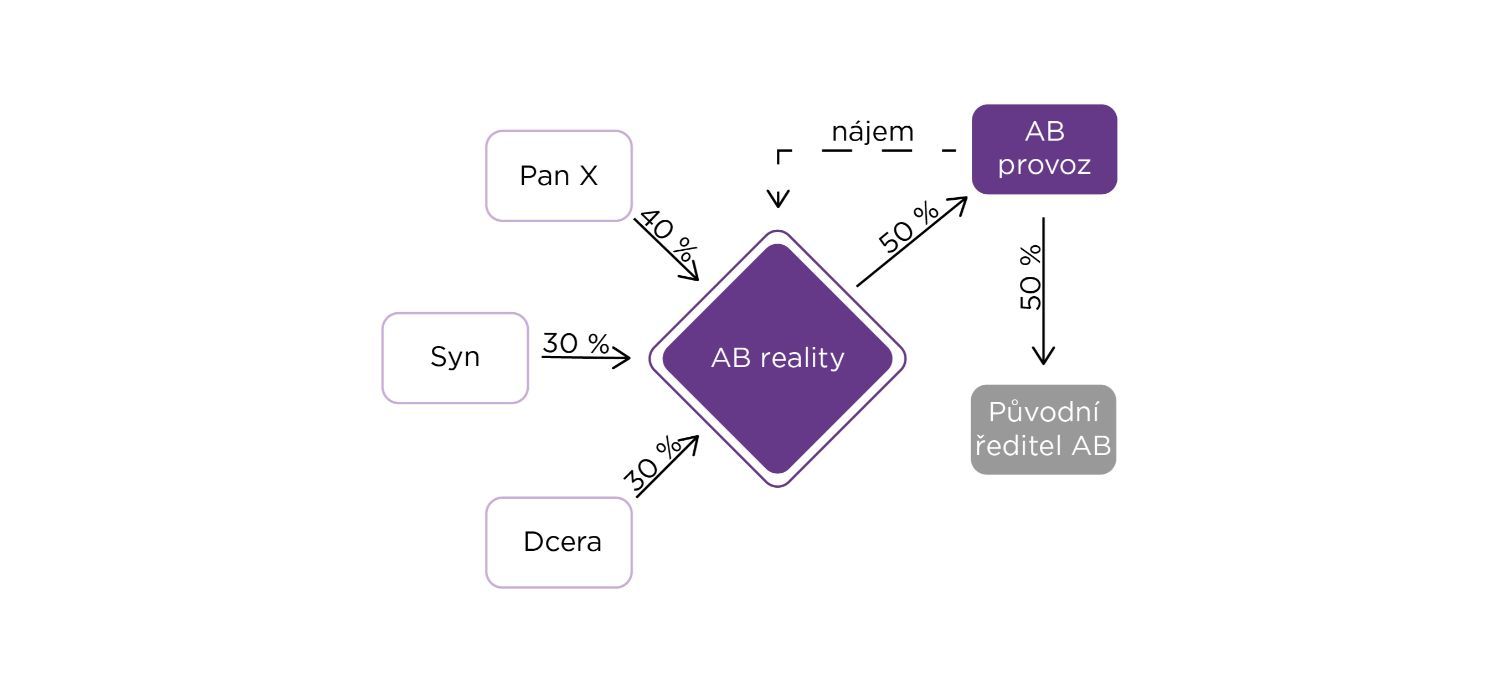

Existing structure

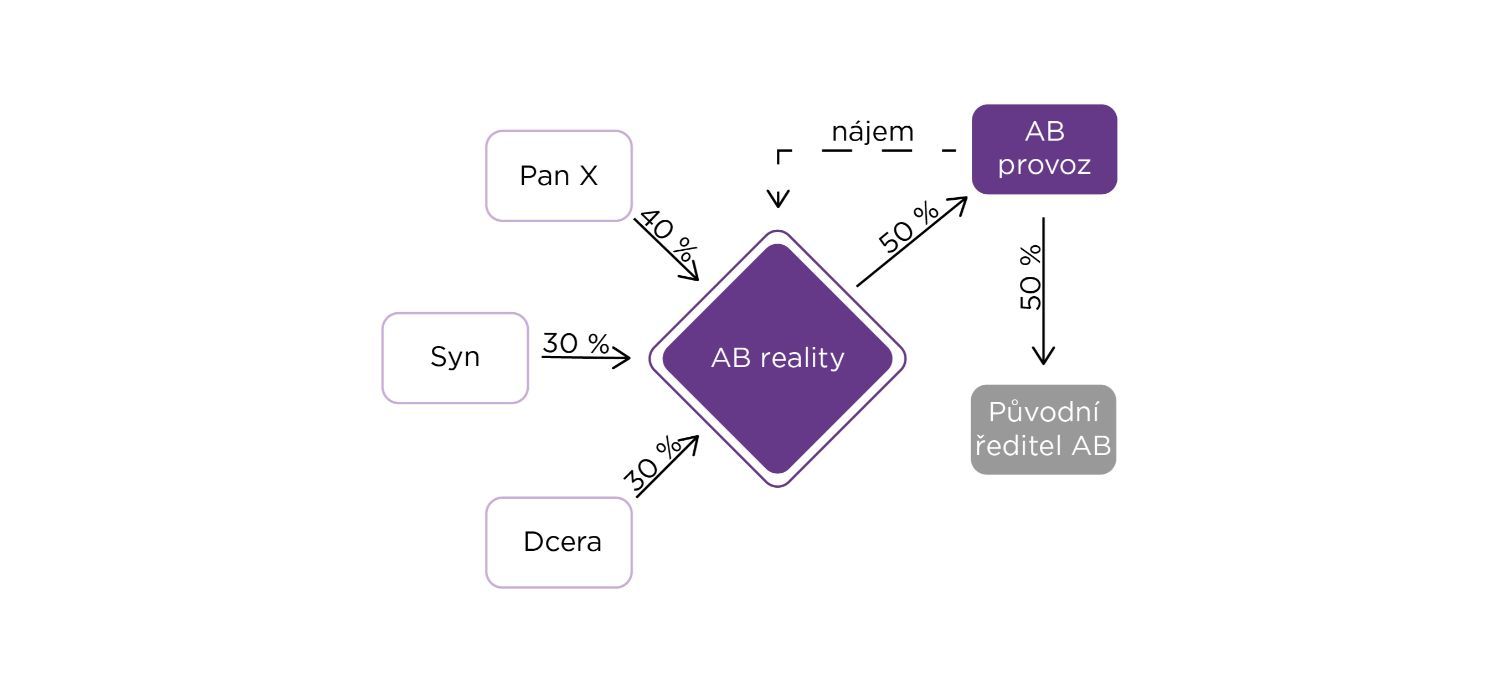

Design of the future state

Design of the future state

We offer an objective perspective on the issue of intergenerational change. Thanks to our experience, broad expert team and reliability, we will support and advise you throughout the process.